Carriage Inwards Debit or Credit

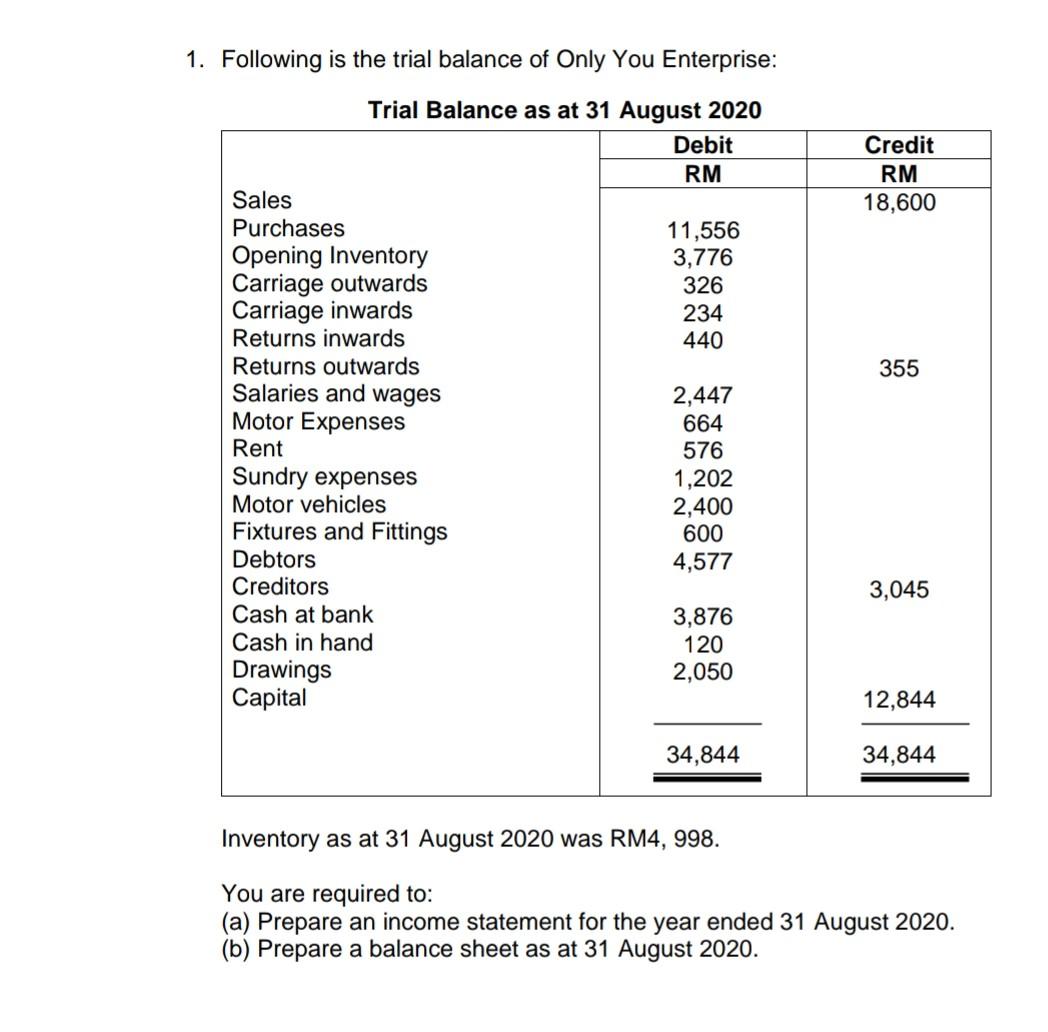

When the credit side exceeds the debit side it shows Gross Profit and if the debit side exceeds the credit side it shows Gross Loss. As we know the discount is of two types a trade discount and cash discount.

Carriage Inwards And Carriage Outwards Double Entry Bookkeeping

The PL ac shows a credit balance when there are profits.

. Indirect expenses are usually shared among. This may happen due to several different reasons in business terminology this action is termed as Sales returns or return inwards. Shown on the debit side of an income statement.

To Capital ac. 20000 120000 47000 12400 1. TS Grewal Solutions for Class 11 Accountancy Chapter 3- Accounting Procedures Rules of Debit and Credit is a major concept to be considered by the students.

The gross profit or loss is transferred to the Profit and Loss Ac. Transferring a credit balance from one account to a second would result in the second account being credited. Carriage inwards 12165 Carriage outwards 26000 Wages 210500 Rent 16000 Light and Heat 3750 Discounts 18940 6060 Telephone 7445 Printing and stationery 10660.

Enter the email address you signed up with and well email you a reset link. Direct expenses can be allocated to a specific product department or segment. Purchases of raw materials carriage on purchases and closing stock of raw materials are given then with the help of the following Materials consumed Direct Material can be calculated.

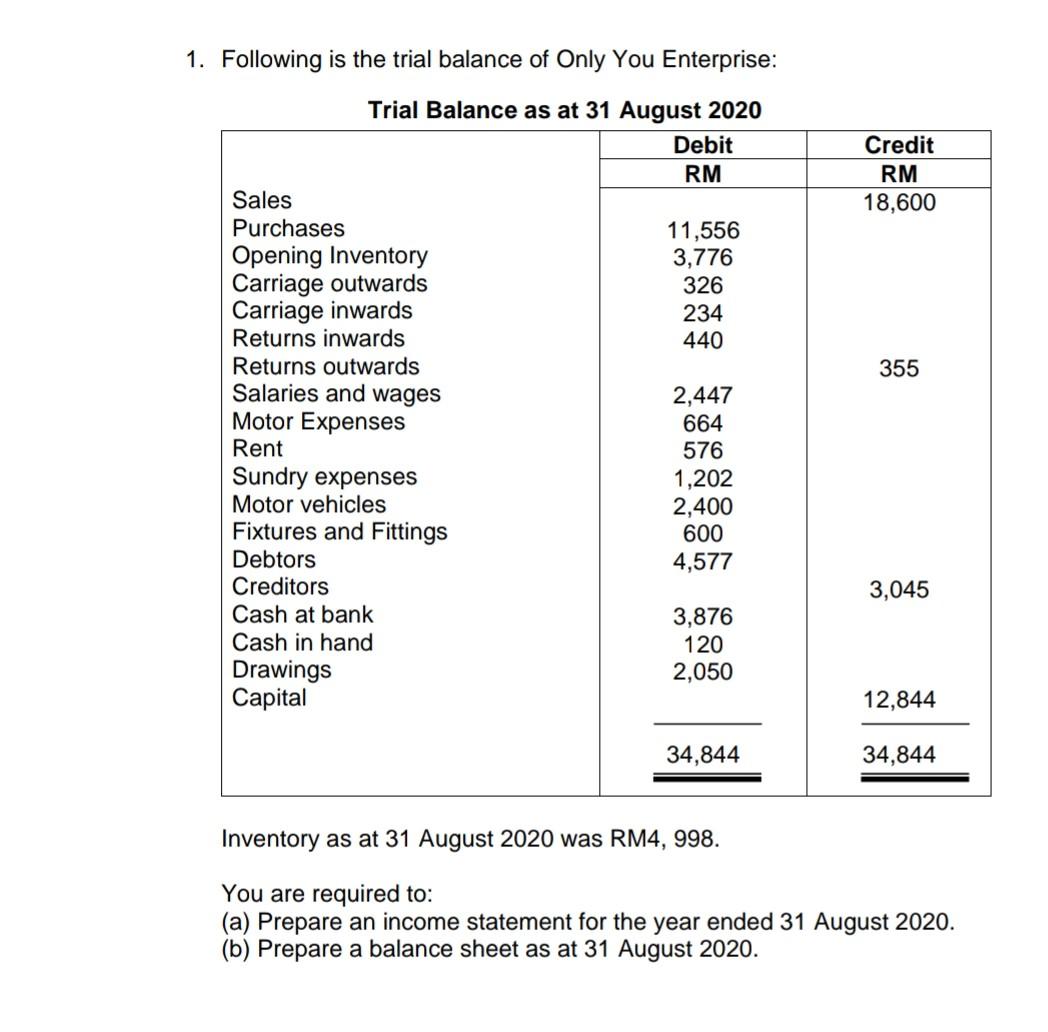

Journal Entry for Sales Returns or Return Inwards Sometimes due to various reasons goods sold by a company may be returned by the respective buyers. Journal entry for sales returns or return inwards is. To carriage inwards.

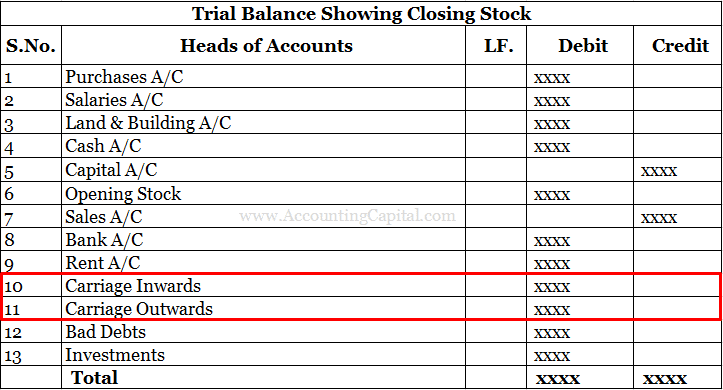

Be informed and get ahead with. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. Carriage Inwards vii Carriage outwards viii Purchases ix Bills Payable x.

K14400 debit 2 marks 110 Blandina had a sales figure of K675000 a gross profit of K275500 and a net profit of. Shown on the debit side of a trading account. The closing entries are as follows.

Here we have rendered in a simplistic and a step by step method which is useful for the students. Transfer of Net Profit. The opening stock will be shown on debit side and closing balance at credit side.

We would like to show you a description here but the site wont allow us. To Opening Stock To Purchases To Wages To Carriage Inwards To Gross Profit. Therefore debit it to Capital Ac.

Enter the email address you signed up with and well email you a reset link. Transportation expenses inwards freight charges inwards import. To loss by firetheft.

The profit and loss account starts with gross profit at the credit side and if there is a gross loss it is shown on the debit side.

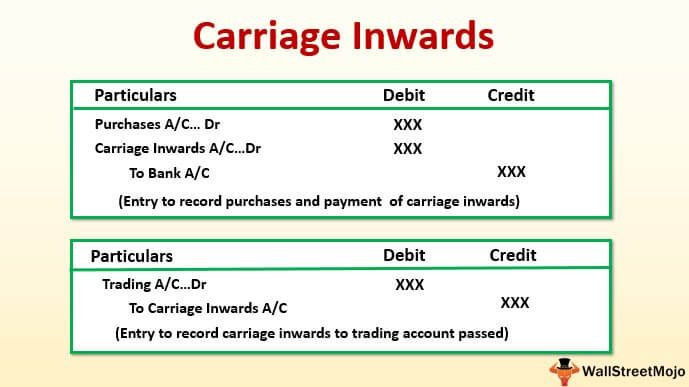

Carriage Inwards Freight Inwards Meaning Debit Or Credit

Solved 1 Following Is The Trial Balance Of Only You Chegg Com

Dheeraj On Twitter Carriage Inwards Freight Inwards Meaning Debit Or Credit Https T Co Ipp7etqzkq Carriageinwards Https T Co 3ozmlvvdwd Twitter

Carriage Outwards Carriage Inwards In Trial Balance Accounting Capital

No comments for "Carriage Inwards Debit or Credit"

Post a Comment